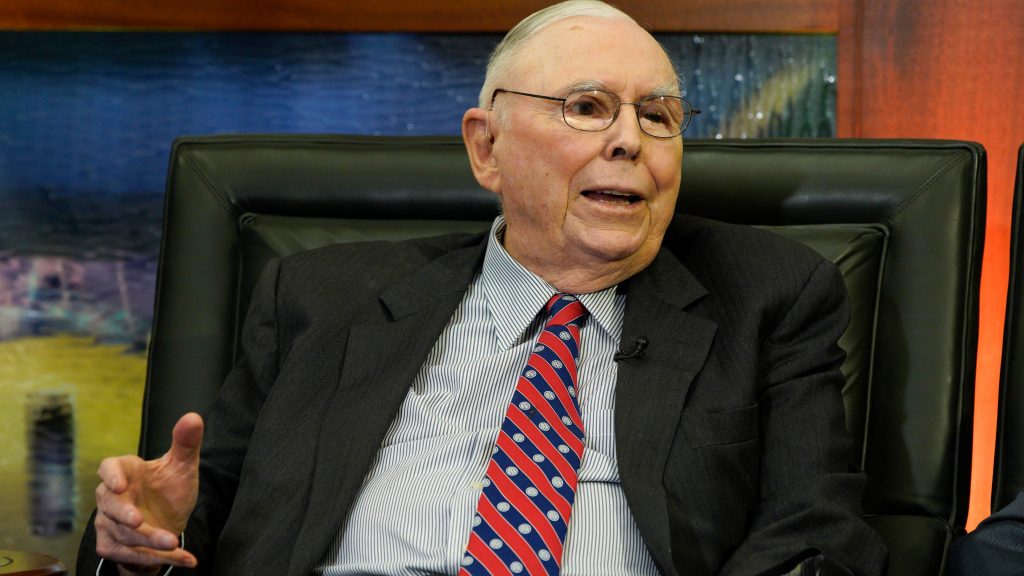

Charlie Munger, a well-known investor and vice chairman of Berkshire Hathaway, spoke out about his thoughts on investing at Wednesday’s annual address. He harshly criticised cryptocurrencies such as Bitcoin and advised investors to not treat the stock market as a gambling parlor.

Munger, 98, stated that he was proud to have avoided the disease. He spoke about Bitcoin at the annual meeting for Daily Journal Corp., the Los Angeles newspaper company, where he has been chairman for many decades.

A billionaire investor who has long criticised cryptocurrencies for their volatility and lack regulation, said Wednesday that the safe assumption for investors was that Bitcoin’s price would be zero in the next 100 years.

He made these comments after Bitcoin, the world’s most popular cryptocurrency, reached a record high last year at over $68,000. This was due to more mainstream adoption by Wall Street. However, its current price is now around $44,000 following a recent downturn.

Munger stated that they already have a digital currency (that’s called a banking account), and that people adopted crypto for its use in illegal activities such as extortion and kidnapping.

Munger said that he ‘admire[s]] the Chinese for banning cryptocurrency’ and that the U.S. had been wrong to allow them. He suggested that the U.S. should also implement a similar ban “immediately.”

The billionaire investor warned of dangerous speculation in the markets and issued dire warnings about inflation. In fact, consumer prices have risen to 40-year highs over recent months.

Important Quote

Munger stated that the great short squeeze in GameStop, and certainly the bitcoin thing, was wretched. He also said that many people view the stock market as a gambling parlor. The billionaire investor says he would tax short-term gains if he could. This would discourage frivolous speculation and increase market liquidity.

What to Watch Out For

Munger described surging inflation as the ‘biggest long-term danger’ we face, aside from a nuclear conflict. Consumer prices are up 7.5% in January’s red-hot inflation reading. The Federal Reserve now feels the pressure to increase interest rates this year.

He was asked how inflation today compares with the rise in prices during 1970s. He said that the current problems could be worse than Volcker’s and would require more work to fix.